The Benefits of Fractional Ownership in Real Estate: Diversify, Multiply, Prosper

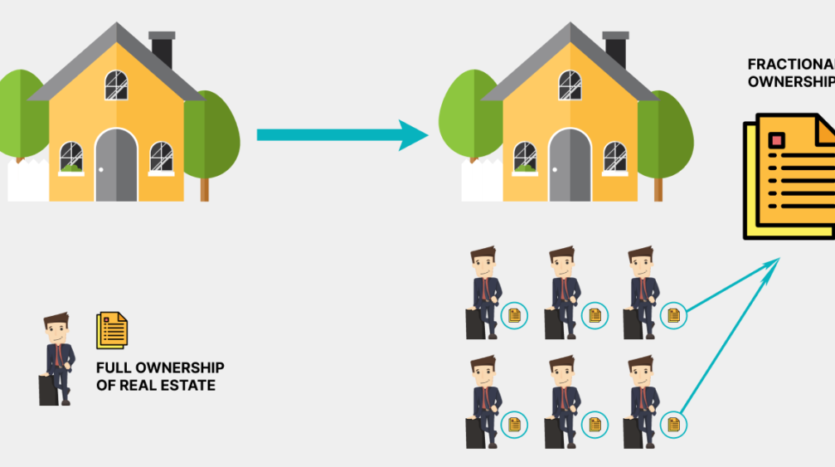

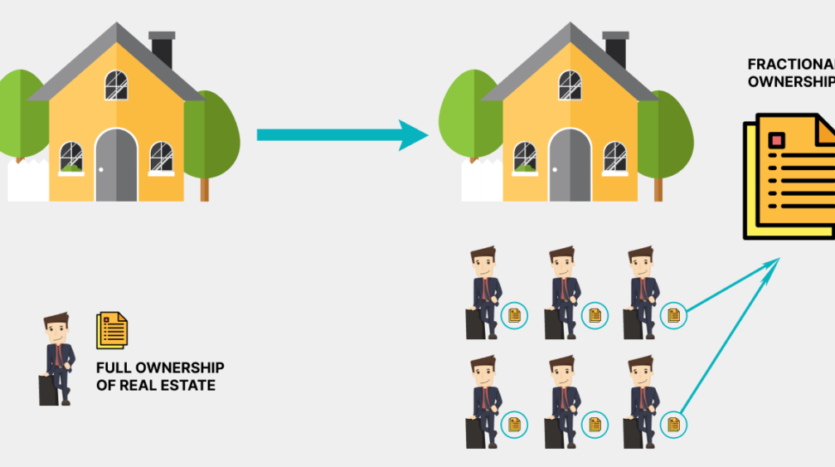

Fractional Ownership is an investment strategy that enables individuals to acquire a fractional share of valuable commercial properties by joining a collective group. By pooling their investment funds, participants can collectively own a portion of the property, aiming to achieve higher returns through this collaborative approach.

Real estate has long been recognized as a lucrative investment, but the high entry costs and management complexities have limited access for many individuals. However, fractional ownership has emerged as a game-changer, revolutionizing real estate investment. In this blog post, we will explore the benefits of fractional ownership and how it enables investors to diversify their portfolios, multiply their opportunities, and prosper in the real estate market.

- Diversification: Spreading Your Risk

Fractional ownership allows investors to diversify their real estate holdings across multiple properties and locations. Instead of tying up substantial capital in a single property, investors can own fractional shares in a diversified portfolio. This diversification reduces risk by minimizing exposure to the performance of a single asset, mitigating potential losses, and increasing the potential for stable returns.

- Access to Premium Properties

Fractional ownership provides access to high-quality properties like M3M Crown, Smart World Floors by M3M, that might otherwise be financially out of reach for individual investors. Whether it’s luxury homes, commercial spaces, or vacation properties, fractional ownership allows investors to own a share in premium assets they may not have been able to afford. This opens doors to exclusive markets and enhances investment potential.

- Increased Investment Opportunities

Fractional ownership expands investment opportunities by offering access to a broader range of real estate assets. Investors can choose from residential, commercial, retail, or hospitality properties, tailoring their portfolios to match their preferences and investment goals. This flexibility allows for better capital allocation and the ability to take advantage of market trends across different sectors.

- Reduced Financial and Management Burden

With fractional ownership, investors can enjoy the benefits of real estate investment without the burden of managing the property themselves. Professional management companies typically handle property maintenance, tenant management, and legal obligations. This alleviates traditional property ownership’s stress and time commitment, allowing investors to focus on their core strengths and other investment opportunities.

- Potential for Higher Returns

Fractional ownership opens the door to higher returns. By pooling resources with other investors, individuals can participate in more extensive and profitable real estate ventures. Additionally, the ability to diversify across multiple properties and markets can increase the chances of capital appreciation and rental income. Fractional ownership also offers the potential for regular income through rental distributions, providing a consistent cash flow stream.

- Enhanced Liquidity

Unlike traditional real estate investments that may require substantial time and effort to sell, fractional ownership offers enhanced liquidity. Investors can quickly exit their fractional ownership positions through secondary markets or buyout options provided by the platform or syndicate. This liquidity feature allows investors to adapt their investment strategy and capitalize on emerging opportunities.

The popularity of fractional ownership in commercial real estate is on the rise in India, coinciding with the anticipated growth of the commercial real estate (CRE) market by 13% to 16% over the next five years. Several factors are expected to drive this surge, including the projected increase in demand for office spaces, the rise in institutional investors, and substantial foreign investments in various commercial projects.

Fractional ownership in real estate presents a paradigm shift in investment possibilities, allowing individuals to diversify their portfolios, multiply their opportunities, and prosper in the real estate market. By embracing fractional ownership, investors gain access to premium properties, reduce financial and management burdens, and benefit from enhanced liquidity. This innovative approach unlocks the potential for higher returns while mitigating risks through diversification. As the fractional ownership market continues to grow, it offers a pathway for investors to harness the power of real estate and pave the way for financial prosperity.

In conclusion, investing with Nesting Abode provides a unique opportunity to earn attractive returns. With our expertise in real estate investment and our innovative approach, we offer a promising avenue for investors seeking financial growth and stability. By leveraging our network, market insights, and strategic investment strategies, you can capitalize on the potential for both ongoing income streams and long-term capital appreciation. Join us on this exciting journey and unlock the potential of real estate investment for your financial success. You can contact us at [email protected]. We are also on Instagram, Facebook and LinkedIn and would be delighted to connect with you there.